Condo Insurance in and around Coram

Coram! Look no further for condo insurance

Quality coverage for your condo and belongings inside

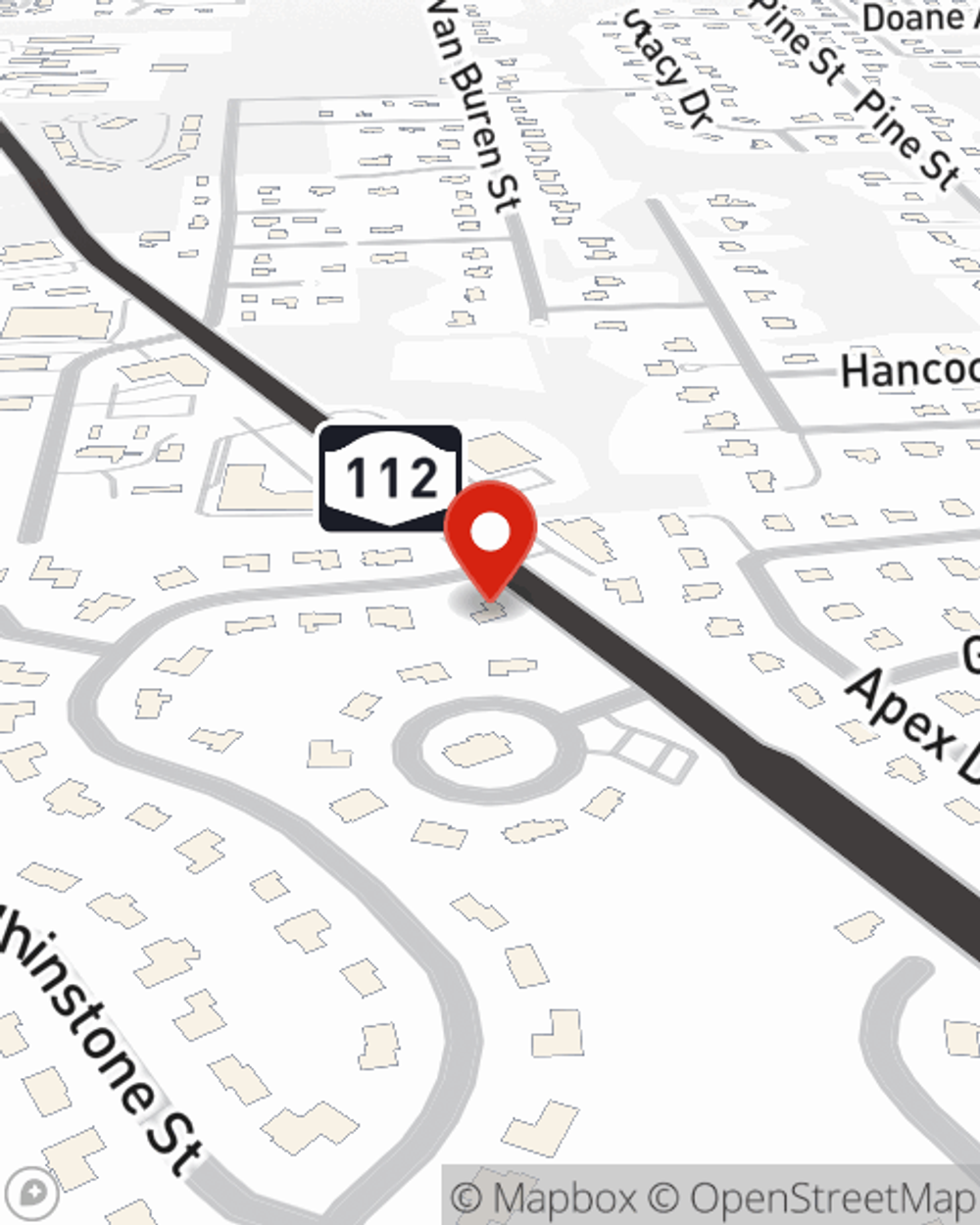

- Coram

- Port Jefferson

- Port Jefferson Sta

- Mount Sinai

- Miller Place

- Medford

- Setauket

- Stony Brook

- Rocky Point

- Selden

- Centereach

Your Search For Condo Insurance Ends With State Farm

With plenty of condo insurance options to choose from, you may be feeling overwhelmed. That's why we made choosing State Farm straightforward. As one of the leading providers of condo unitowners insurance, you can enjoy remarkable service and coverage that is competitively priced. And this is not only for your condo but also for your personal belongings inside, including things like appliances, sound equipment and videogame systems.

Coram! Look no further for condo insurance

Quality coverage for your condo and belongings inside

Why Condo Owners In Coram Choose State Farm

It's no secret that life is full of surprises, which is all the more reason to be prepared for the unexpected with condo unitowners insurance. This can include instances of liability or covered damage to your condo from an ice storm, a hailstorm or water damage.

That’s why your friends and neighbors in Coram turn to State Farm Agent Patty Herbstman. Patty Herbstman can help clarify your liabilities and help you make sure your bases are covered.

Have More Questions About Condo Unitowners Insurance?

Call Patty at (631) 509-6890 or visit our FAQ page.

Simple Insights®

Chillin’ and grillin’: Check out our safety tips for outdoor grilling with charcoal and gas

Chillin’ and grillin’: Check out our safety tips for outdoor grilling with charcoal and gas

Help prevent accidents and disasters by knowing the risks, knowing what to watch out for and by following the steps for safe grilling.

Insurance issues to consider when hosting a house party

Insurance issues to consider when hosting a house party

Having the right amount of insurance can help protect you when you're hosting a party. Use these tips to make sure you're covered.

Patty Herbstman

State Farm® Insurance AgentSimple Insights®

Chillin’ and grillin’: Check out our safety tips for outdoor grilling with charcoal and gas

Chillin’ and grillin’: Check out our safety tips for outdoor grilling with charcoal and gas

Help prevent accidents and disasters by knowing the risks, knowing what to watch out for and by following the steps for safe grilling.

Insurance issues to consider when hosting a house party

Insurance issues to consider when hosting a house party

Having the right amount of insurance can help protect you when you're hosting a party. Use these tips to make sure you're covered.